Dec 13, 2018 | Industry News, Regulatory Updates

The IRS announced Notice 1036 which includes information on the percentage method tables for tax withholding, withholding adjustment for Nonresident aliens, Withholding on Supplemental wages, and much more. Withholding allowance amounts for payroll periods have...

Pay Equity and Salary History Bans

Dec 7, 2018 | Industry News, Regulatory Updates

Pay Equity Laws Employers need to be aware Pay Equity Laws are not new. The Federal Equal Pay Act was passed in 1963. Many states have passed similar laws which have been around for decades. However, enforcement of these state laws is picking up steam, and more...

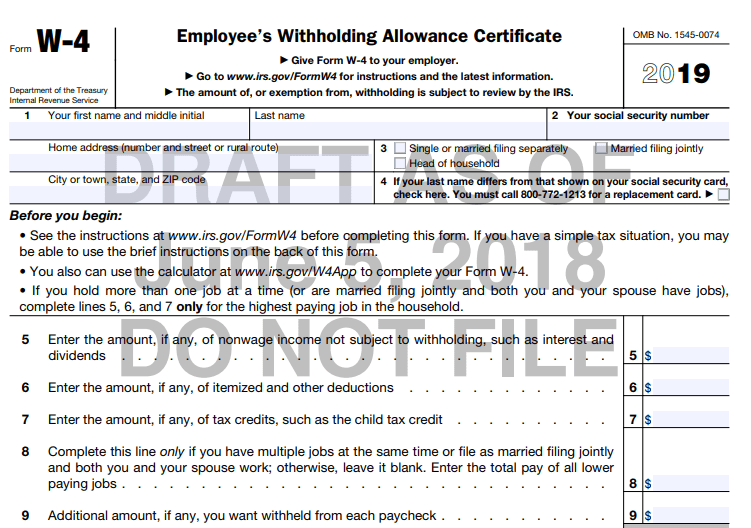

Form W-4 Update Delayed until 2020

Sep 25, 2018 | Industry News, Regulatory Updates

The Internal Revenue Service (IRS) announced last Thursday that it will delay major revisions to the Form W-4, Employee’s Withholding Allowance Certificate, until the 2020 version. The 2019 version of the Form W-4 will be similar to the current 2018 version and will...

New Jersey’s Paid Sick Leave Law

Jul 18, 2018 | Industry News, Regulatory Updates

New Jersey has become the 10th state to adopt mandatory paid sick leave. The law goes into effect on October 29, 2018 and provides up to 40 hours of paid sick leave per year to covered employees. The state sick leave law overrides all current municipal ordinances....

Paycheck Checkup Flyer Helps Prevent Surprise at Tax Time

Jul 16, 2018 | Industry News, Regulatory Updates

The Internal Revenue Service (IRS) released a one-page “Paycheck Checkup” flyer earlier this month. Its purpose is to encourage employers to remind employees that they should review their federal income tax withholding allowances. Doing so may help prevent a...

New Minimum Wage Rates Effective July 1, 2018

Jun 26, 2018 | Regulatory Updates

Several states and localities, including those in Illinois, Maryland, Washington, DC, California, Maine, Minnesota and Oregon will raise the minimum wage effective Sunday, July 1, 2018. The updated hourly rates include: Chicago, IL: $12.00 Cook County, IL: $11.00...