Jun 16, 2020 | Regulatory Updates, Small Business Resources

As businesses reopen their offices and workplaces, employers must act to provide safe and healthy working environments. During his webinar, Kara Govro, Senior Legal Analyst of Mammoth HR, discussed safety strategies for offices as well as workplaces open to the...

Jun 11, 2020 | Human Resources, Industry News

On June 3, 2020, the United States Congress took action to modify rules and regulations put in place by the Small Business Administration and the Treasury Department regarding the Paycheck Protection Program. The bill was signed by the President on June 5, 2020. ...

Jun 6, 2020 | Human Resources

As an organization, you may be asking “How can I make our workplace more inclusive, diverse, and equitable for all employees?” For these efforts to be successful, employees need to be able to speak freely, offering critical and candid feedback about individual...

Jun 3, 2020 | Human Resources, Regulatory Updates

Flexibility during a crisis may make sense in certain situations, but there are some areas where you don’t want to fall short of your usual standards. Documentation is certainly one of those. Documentation is an important part of risk management, and the price of not...

Jun 2, 2020 | Human Resources, Regulatory Updates

Question: Does “at-will employment” mean we can terminate without risk? Answer: No, termination always comes with some risk, even when the employment is at-will. While at-will employment allows either you or the employee to terminate the employment relationship at...

May 28, 2020 | Human Resources, Regulatory Updates

Are you expecting PPP funds or have already received them? Wait before you begin to spend this! There are important SBA guidelines you should know in order to have your loan forgiven and to avoid fraud charges or jail time. On Wednesday, May 27, Corporate...

May 20, 2020 | Human Resources, Regulatory Updates

Some of the largest payroll companies in the country are not filing the Form 7200, Advance Payment of Employer Credits Due to COVID-19 for their clients. We are!The paid sick leave and paid family leave credits are designed to immediately reimburse eligible employers...

May 15, 2020 | Human Resources, Regulatory Updates

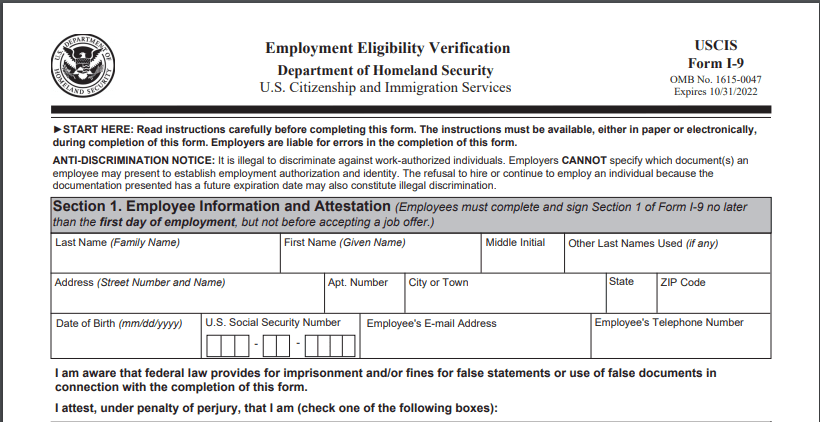

The Department of Homeland Security (DHS) has issued a temporary policy to allow employers to accept expired List B documents when completing the Form I-9 beginning May 1. This policy is intended to account for the fact that many people are unable to renew their...

May 8, 2020 | Human Resources

Small and midsize employers can claim two new refundable payroll tax credits. The paid sick leave credit and the paid family leave credit are designed to immediately and fully reimburse eligible employers for the cost of providing COVID-19 related leave to their...

May 7, 2020 | Human Resources

The spread of the Coronavirus (COVID-19) has employers concerned about keeping the workplace safe without violating laws in the process. Thankfully, the Equal Employment Opportunity Commission (EEOC) has answered some common questions that employers are asking. ...

May 1, 2020 | Human Resources, Regulatory Updates, Small Business Resources

Employers who are filing Form 7200, Advance Payment of Employer Credits Due to COVID-19 should read the instructions carefully and take their time when completing this form to avoid mistakes. Here are some common errors to avoid when filling out Form 7200: Missing or...

Apr 29, 2020 | Human Resources

We understand that transitioning your entire team from working on-site to working from home can be a difficult process. Here are a few ways we can help simplify this process for you: Come Aboard Benefits: With our digital onboarding application, you can: Store...

Apr 17, 2020 | Human Resources, Workers Comp

Most businesses today are very interested in conserving as much cash as possible. Keep reading to learn how something we call, “Pay as you go” (PAYG) workers comp insurance, can improve your cash flow.All states except Texas require workers compensation coverage for...

Apr 16, 2020 | Human Resources

Taxpayers should be on the lookout for IRS impersonation calls, texts and email phishing attempts about the coronavirus or COVID-19 Economic Impact Payments. These scams can lead to tax-related fraud and identity theft. Here’s what taxpayers should know: The IRS will...

IRS issues warning about Coronavirus-related scams

Apr 7, 2020 | Human Resources

On April 2, 2020, the Internal Revenue Service urged taxpayers to be on the lookout for a surge of calls and email phishing attempts about the Coronavirus, or COVID-19. These contacts can lead to tax-related fraud and identity theft. “We urge people to take...

DHS Relaxes In-Person I-9 Inspection Requirements

Apr 6, 2020 | Human Resources

The physical presence requirement of the Employment Eligibility Verification, Form I-9, requires that employers, or an authorized representative, physically examine, with the employee present, the unexpired document(s) the employee presents from the Lists of...

Families First Coronavirus Response Act Updates and CARES Act Provisions

Apr 2, 2020 | Human Resources

Families First Coronavirus Response Act Since the enactment of the Families First Coronavirus Response Act on March 18, new information and guidance has been released periodically. Below you will find a summary of the most relevant information. We will continue to...

SBA to Provide Disaster Assistance Loans for Small Businesses Impacted by Coronavirus (COVID-19)

Mar 26, 2020 | Human Resources

The U.S. Small Business Administration is offering low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the coronavirus (COVID-19). Small business owners in all U.S. states and territories...

How to Pay for Leave Required by Families First Coronavirus Response Act

Mar 24, 2020 | Benefits, Human Resources, Industry News

Including the information in the link below, this is all we currently know about the payroll tax credit under the FFCRA and how to access or administer it. We will update the HR Support Center as soon as new information or guidance is available. On Friday, March 20,...

President Signs Emergency Paid Sick or Family Leave Legislation

Mar 20, 2020 | Benefits, Human Resources, Industry News

On March 18, President Trump signed H.R. 6201, the Families First Coronavirus Response Act, which includes several payroll-related provisions. Emergency Paid Sick Leave Effective April 2 through December 31, 2020, private employers with fewer than 500 employees...