Nov 4, 2019 | Industry News

Taxpayers should be on the lookout for new variations of tax-related scams. In the latest twist on a scam related to Social Security numbers, scammers claim to be able to suspend or cancel your SSN. It’s yet another attempt by con artists to frighten you into...

IRS announces 2019 Percentage Method Tables for Income Tax

Dec 13, 2018 | Industry News, Regulatory Updates

The IRS announced Notice 1036 which includes information on the percentage method tables for tax withholding, withholding adjustment for Nonresident aliens, Withholding on Supplemental wages, and much more. Withholding allowance amounts for payroll periods have...

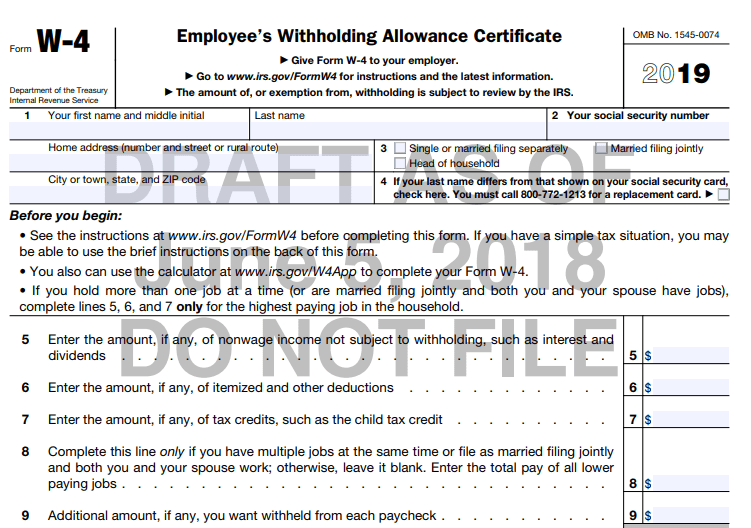

Form W-4 Update Delayed until 2020

Sep 25, 2018 | Industry News, Regulatory Updates

The Internal Revenue Service (IRS) announced last Thursday that it will delay major revisions to the Form W-4, Employee’s Withholding Allowance Certificate, until the 2020 version. The 2019 version of the Form W-4 will be similar to the current 2018 version and will...

Paycheck Checkup Flyer Helps Prevent Surprise at Tax Time

Jul 16, 2018 | Industry News, Regulatory Updates

The Internal Revenue Service (IRS) released a one-page “Paycheck Checkup” flyer earlier this month. Its purpose is to encourage employers to remind employees that they should review their federal income tax withholding allowances. Doing so may help prevent a...

What you need to know about 1099 contractors

May 23, 2018 | Industry News

In the era of the “gig economy,” where businesses hire freelancers and independent contractors (ICs) for short-term engagements, business owners may run into questions about whether workers are truly ICs, or really just part-time or even full-time employees. ...